Table of Contents

Preface The elaboration of Banking

Banking in the United States is witnessing a significant metamorphosis. If you ’ve been keeping an eye on U.S. bank branch news, you know that the geography is shifting fleetly. This is n’t just about fancy new tech; it’s about reconsidering the entire client experience.

Gone are the days when a bank was just a place to store your cash or get a loan. moment, branches are getting community capitals, tech exhibits, and centers of fiscal heartiness. Let’s dive into what’s passing on the frontlines of U.S. banking.

The Rise of the Tech- Enhanced Branch

First over, let’s talk tech. Banks are investing heavily in technology to enhance the branch experience. Walking into a ultramodern bank moment feels more like stepping into a high- tech chesterfield than a traditional fiscal institution.

You might find interactive touchscreens, tone- service alcoves, and indeed virtual reality stations designed to educate guests about fiscal products. These inventions aim to make banking more intuitive and engaging. also, they help streamline services, reducing delay times and perfecting effectiveness.

The part of AI and robotization

On the content of technology, we ca n’t ignore the impact of AI and robotization. numerous U.S. bank branches are now employing AI- driven tools to help with everything from client service to fraud discovery.

AI chatbots, for case, are getting a common sight, furnishing guests with instant answers to their queries. also, automated processes are speeding up loan blessings and regard openings, making the entire banking process smoother and faster for everyone involved.

Also read: RIDING THE WAVE OF STYLE: THE ULTIMATE GUIDE TO OUTER BANKS STICKERS 2024

Redefining client Service

While tech is pivotal, the mortal element of banking remains irreplaceable. Recent U.S. bank branch news highlights a renewed focus on substantiated client service. Banks are training their staff to give acclimatized fiscal advice, moving beyond transactional relations to erecting deeper connections with guests.

fiscal counsels are now more accessible, frequently meeting guests in relaxed, chesterfield- suchlike settings within branches. This shift aims to make banking more particular and less intimidating, encouraging guests to seek advice and make informed fiscal opinions.

Community- Centric Branches

One of the most instigative trends in U.S. bank branches is the move towards community- centric designs. Banks are reimagining their spaces to serve as community capitals, hosting events, shops, and fiscal knowledge programs.

These branches are designed to be drinking and inclusive, frequently featuring original art and community boards. By fostering a sense of community, banks are situating themselves as integral corridor of their neighborhoods, not just places for deals.

Sustainable Banking Practices

Sustainability is another hot content in U.S. bank branch news. numerous banks are committing toeco-friendly practices, both in their operations and their physical spaces. From energy-effective structures to paperless deals, the drive for green banking is gaining instigation.

Branches are being erected or repaired with sustainability in mind, usingeco-friendly accoutrements and technologies. This not only reduces the environmental impact but also resonates with guests who value commercial responsibility and environmental stewardship.

The Digital- Physical Hybrid

Despite the rise of digital banking, physical branches are n’t going anywhere. rather, we ’re seeing a mix of digital and physical services that round each other. This mongrel approach allows guests to enjoy the convenience of online banking while still having access to in- person support when demanded.

For case, numerous banks now offer online appointment reserving for branch visits, icing that guests can get the help they need without staying in line. This flawless integration of digital and physical channels enhances the overall client experience.

Financial Wellness Programs

Another crucial trend in U.S. bank branches is the emphasis on fiscal heartiness. Banks are decreasingly offering programs and services aimed at helping guests manage their finances more effectively.

From budgeting shops to withdrawal planning sessions, these enterprise are designed to educate and empower guests. By fastening on fiscal heartiness, banks can make stronger connections with their guests and support their long- term fiscal health.

The Impact of COVID- 19

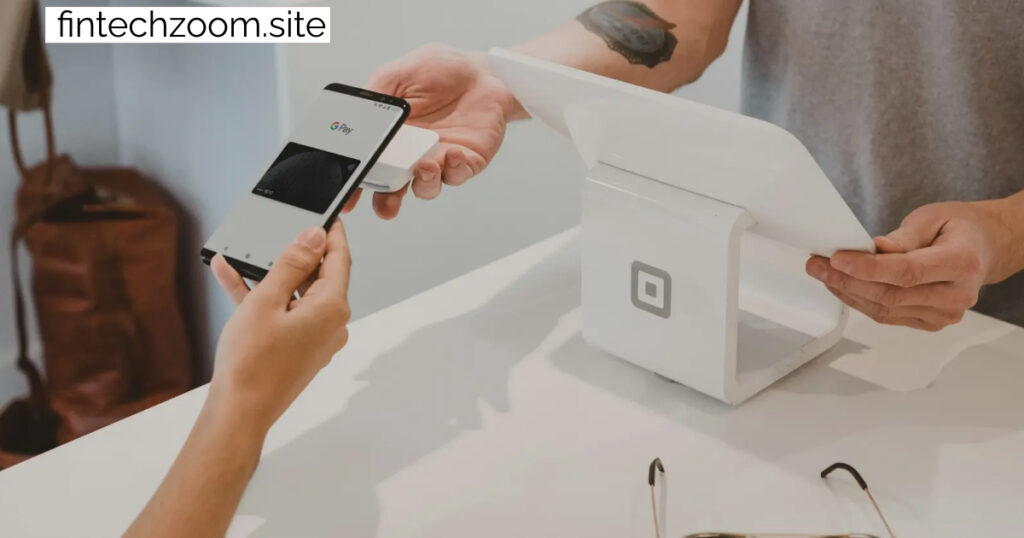

The COVID- 19 epidemic has had a profound impact on U.S. bank branches. originally, numerous branches were forced to close or operate on reduced hours. still, this period also accelerated the relinquishment of digital banking and contactless services.

Banks snappily acclimated by enforcing safety measures and enhancing their online immolations. Now, as branches renew, they’re incorporating assignments learned during the epidemic to give safer, more effective services. This includes everything from bettered online banking platforms to enhanced in- branch safety protocols.

The Future ofU.S. Bank Branches

So, what does the unborn hold for U.S. bank branches? While it’s insolvable to prognosticate with certainty, current trends suggest a continued focus on technology, personalization, and community engagement.

We can anticipate to see further branches incorporating slice- edge technologies, from AI and robotization to virtual reality. also, the trend towards community- centric designs and sustainable practices is likely to continue, reflecting broader societal values and client prospects.

Conclusion Embracing Change

In conclusion, the world of U.S. bank branches is evolving at a rapid-fire pace. From tech- enhanced branches and AI- driven tools to community- centric designs and sustainability enterprise, the changes are both instigative and transformative.

As we look to the future, it’s clear that banks will continue to introduce, chancing new ways to enhance the client experience and meet the evolving requirements of their communities. By embracing these changes, banks aren’t only staying applicable but also playing a pivotal part in shaping the future of banking.

FAQs About U.S. Bank Branch News

What new technologies are being introduced in U.S. bank branches?

A: Modern U.S. bank branches are incorporating technologies such as interactive touchscreens, self-service kiosks, and virtual reality stations designed to educate customers about financial products. These technologies aim to enhance the customer experience and streamline banking services.

Q: How are banks using AI and automation?

A: Banks are employing AI-driven tools for customer service, fraud detection, and more. AI chatbots provide instant answers to customer queries, and automated processes speed up loan approvals and account openings, making banking faster and more efficient.

Q: What role do AI chatbots play in customer service?

A: AI chatbots are now common in many bank branches, offering real-time assistance to customers. They handle a wide range of queries, freeing up human staff to focus on more complex issues.

Q: How does AI help in providing personalized service?

A: AI tools analyze customer data to provide tailored financial advice. This ensures that customers receive relevant and timely support, enhancing their overall experience.

Q: What types of financial wellness programs do banks offer?

A: Banks offer a variety of financial wellness programs, including budgeting workshops and retirement planning sessions. These initiatives aim to educate customers and help them manage their finances more effectively.

Q: How do financial advisors in branches assist customers?

A: Financial advisors provide tailored advice to customers, helping them make informed financial decisions and plan for the future. This focus on personalized service strengthens customer relationships.

Q: What is a community-centric bank branch?

A: A community-centric bank branch is designed to serve as a community hub, hosting events, workshops, and financial literacy programs. These branches foster a sense of community and engagement.

Q: How do branches integrate with their local communities?

A: Branches often feature local art and community boards, creating a welcoming and inclusive environment. This helps banks build stronger connections with the neighborhoods they serve.

Q: How are banks incorporating sustainability into their operations?

A: Banks are committing to eco-friendly practices by constructing energy-efficient buildings and using sustainable materials. This reduces their environmental impact and aligns with broader corporate responsibility goals.

Q: What are paperless transactions, and why are they important?

A: Paperless transactions minimize waste and promote digital banking. This shift towards paperless operations is part of a larger effort to adopt more sustainable practices.