Table of Contents

Welcome to the World of Computerized Deception

Hey there, tech-savvy peruser! Let’s take a travel together through a unconventional, however progressively common, corner of the computerized world: the fake bank account app. This term might sound like something out of a science fiction novel, but it’s a exceptionally genuine and developing concern in our high-tech society.

Fake bank account apps are computer program applications that mirror the appearance and usefulness of authentic keeping money apps. They’re planned to trap clients into accepting they’re getting to their genuine bank accounts, but in reality, these apps are utilized to take touchy data. As more of our monetary exercises move online, understanding these false instruments is crucial.

A Brief History of Budgetary Fraud

Before we plunge into the nitty-gritty of fake bank account apps, let’s take a step back in time. Money related extortion is not a modern concept. Keep in mind the scandalous Ponzi plans or the con craftsmen of the 20th century who would produce checks? Those were the predecessors of today’s advanced scams.

Fast forward to the 21st century, the advancement of the web brought approximately a unused play area for fraudsters. Mail phishing tricks and fake websites got to be uncontrolled. Presently, with the broad utilize of smartphones, we’re seeing a modern breed of extortion: fake bank account apps. These apps are the most recent apparatuses in the weapons store of cybercriminals, adjusting ancient traps to modern technologies.

What Precisely is a Fake Bank Account App?

Alright, so what’s the bargain with these fake bank account apps? Basically put, they are pernicious applications that see and work like veritable keeping money apps. Be that as it may, their essential reason is to collect your individual and money related data, which can at that point be utilized for different shapes of robbery and fraud.

The modernity of these apps can be surprising. A few of them not as it were mirror the interface of genuine keeping money apps but moreover show fake equalizations, exchange histories, and indeed have client bolster highlights. This level of detail makes it inconceivably challenging for the normal client to recognize between a fake and a genuine app.

Also read: REVOLUTIONIZING BANKING: EXPLORING THE FINTECHZOOM BEST NEOBANKS

How Do These Apps Work?

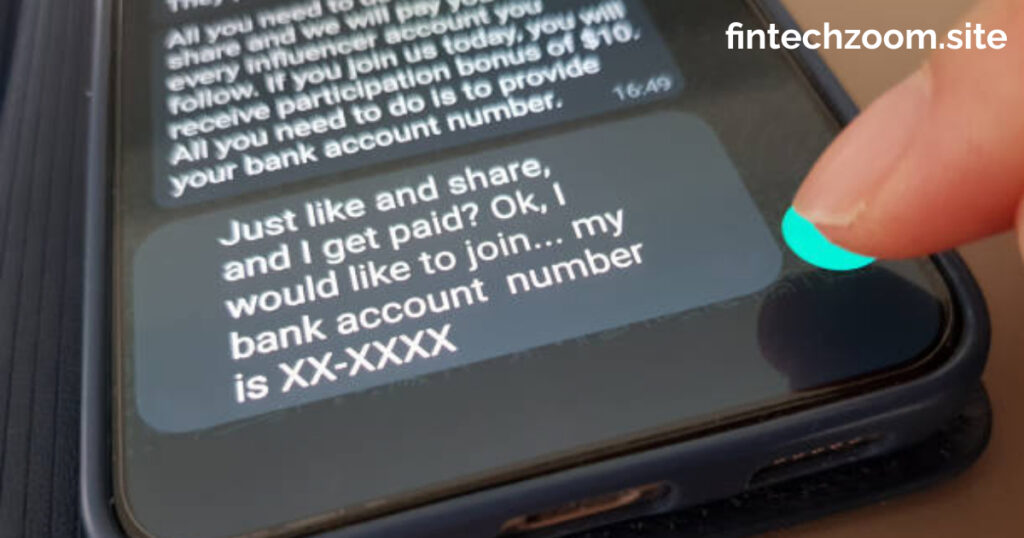

Understanding how these fake bank account apps work can offer assistance you spot them. Regularly, these apps are dispersed through informal app stores or through pernicious joins in emails or content messages. Once introduced, they might work in two ways.

First, they can act as a phishing device, capturing login qualifications when you attempt to get to your “account.” Moment, they can perform foundation operations, taking data unobtrusively without any obvious sign of false movement. A few progressed forms indeed captured SMS messages to pick up get to to two-factor verification codes, making them especially dangerous.

The Real-Life Affect: Stories from Victims

Let’s put a confront to the stats. Consider Jane, a little trade proprietor. One day, she gotten an mail from what showed up to be her bank, encouraging her to download their modern versatile app for upgraded security. Trusting the source, Jane downloaded the app and logged in. Inside hours, her trade account was depleted of thousands of dollars.

Or take the case of Alex, a college understudy. Alex bumbled upon a managing an account app advertising profitable understudy rebates. Energized, he downloaded the app and entered his points of interest. Not long after, he taken note a few unauthorized exchanges on his account. These stories are fair a few illustrations of the ruin fake bank account apps can wreak on clueless individuals.

The Budgetary and Enthusiastic Toll

The budgetary misfortune from these tricks is frequently quick and obliterating, but the passionate affect can be long-lasting. Casualties not as it were lose cash but too their sense of security and believe. The handle of recuperating from such an assault includes more than fair getting your cash back; it incorporates reestablishing your confidence in the advanced money related system.

Moreover, the passionate trouble can be noteworthy. The feeling of being abused, coupled with the dissatisfaction of exploring through extortion reports and the legitimate framework, can be overpowering. It’s a stark update of the significance of carefulness in our computerized age.

Recognizing the Ruddy Flags

Now, let’s arm ourselves with information. Spotting a fake bank account app some time recently it does any harm is the to begin with line of defense. Here are a few ruddy banners to observe out for:

Firstly, pay consideration to the source of the app. Continuously download keeping money apps from official app stores like Google Play or the Apple App Store. If you get an mail or content message provoking you to download an app, be wary.

Secondly, see at the app’s audits and evaluations. Fake apps regularly have destitute audits or exceptionally few appraisals. Also, scrutinize the app’s authorizations. If it’s inquiring for more authorizations than vital, like get to to your contacts or messages, it’s a ruddy flag.

Shielding Your Information

So, what can you do to secure yourself? Firstly, continuously utilize multi-factor verification (MFA) for your bank accounts. MFA includes an additional layer of security, making it harder for fraudsters to get to your account indeed if they have your login credentials.

Regularly overhaul your passwords and utilize solid, interesting passwords for each of your accounts. Maintain a strategic distance from utilizing the same watchword over different locales. Furthermore, keep your smartphone’s working framework and apps overhauled to ensure against the most recent security vulnerabilities.

The Part of Banks and Authorities

Banks and administrative specialists are not sitting sit out of gear. They’re always moving forward their security measures and teaching clients almost potential dangers. Numerous banks presently offer secure keeping money apps with progressed encryption and biometric verification features.

Authorities are too splitting down on these tricks. Cybercrime units around the world are working energetically to track down and arraign those behind fake bank account apps. Be that as it may, the fight is progressing, and remaining educated and careful is the best defense.

The Future of Computerized Managing an account Security

Looking ahead, what does the future hold for advanced keeping money security? As innovation advances, so as well will the strategies of fraudsters. Be that as it may, progressions in counterfeit insights and machine learning are giving unused ways to distinguish and avoid false activities.

Biometric confirmation strategies, such as facial acknowledgment and unique mark checking, are getting to be more predominant and modern. Furthermore, blockchain innovation has the potential to offer exceptional security in money related exchanges. The key is to remain ahead of the bend and ceaselessly adjust to unused threats.

Teaching the Masses

One of the most capable apparatuses against fake bank account apps is instruction. By spreading mindfulness and teaching the masses around the perils of these apps, we can essentially diminish their affect. Schools, community organizations, and online stages play a pivotal part in this instructive effort.

Moreover, sharing real-life stories and encounters can make the issue more relatable and impactful. When individuals get it the real-world results of these tricks, they’re more likely to take proactive steps to ensure themselves.

Commonsense Steps to Take if You’re a Victim

If you discover yourself a casualty of a fake bank account app, don’t freeze. Here are a few viable steps you can take. To begin with, instantly contact your bank and report the false movement. They can offer assistance secure your account and direct you through the handle of recuperating any misplaced funds.

Next, report the app to the app store and any significant specialists, such as the Government Exchange Commission (FTC) in the Joined together States. This makes a difference anticipate others from falling casualty to the same trick. Moreover, consider looking for back from a budgetary advisor or counselor to offer assistance explore the consequence and reestablish your money related health.

The Brain research Behind Falling for Scams

It’s vital to get it that anybody can drop casualty to a fake bank account app. Scammers are talented at abusing human brain research, utilizing strategies like criticalness, fear, and believe control to trap people.

For case, a common strategy is making a sense of direness by claiming your account will be bolted unless you download the app instantly. Understanding these mental strategies can offer assistance you remain careful and stand up to the encourage to act imprudently when gone up against with potential scams.

Building a Community of Awareness

Let’s confront it; battling advanced extortion is not a solo endeavor. Building a community of mindfulness and bolster can make a tremendous contrast. Share data almost fake bank account apps with companions and family. Empower talks approximately online security and security.

Participate in online gatherings and social media bunches devoted to cybersecurity. By cultivating a community that values and prioritizes advanced security, we can collectively make it harder for fraudsters to succeed.

Remaining Ahead of the Curve

Finally, remaining ahead of the bend is key. Keep side by side of the most recent advancements in cybersecurity and computerized extortion avoidance. Take after trustworthy sources of data, such as cybersecurity blogs, news outlets, and industry reports.

Consider taking online courses or going to workshops on advanced security. The more you know, the way better prepared you’ll be to ensure yourself and your cherished ones from the danger of fake bank account apps.

Conclusion: Enable Yourself in the Computerized Age

Navigating the computerized world can be overwhelming, but with the right information and apparatuses, you can ensure yourself from the developing danger of fake bank account apps. By understanding how these apps work, recognizing the ruddy banners, and taking proactive measures, you can protect your monetary data and appreciate the benefits of computerized managing an account with peace of mind.

Remember, instruction and carefulness are your best protections. Remain educated, remain associated, and engage yourself to explore the advanced age securely. Together, we can unmask the computerized misdirection and construct a more secure online community.

FAQ: Everything You Need to Know About Fake Bank Account Apps

1. What is a fake bank account app?

A fake bank account app is a malicious software application designed to mimic the appearance and functionality of legitimate banking apps. Its primary goal is to deceive users into providing personal and financial information, which can then be used for theft and fraud.

2. How do fake bank account apps work?

These apps often operate by either capturing login credentials when users attempt to access their “account” or performing background operations to steal information quietly. Some advanced versions can intercept SMS messages to gain access to two-factor authentication codes.

3. How can I spot a fake bank account app?

To spot a fake bank account app, download banking apps only from official app stores like Google Play or the Apple App Store. Be wary of apps promoted through emails or text messages. Check the app’s reviews and ratings, and scrutinize the permissions it requests. Excessive permissions can be a red flag.

4. What should I do if I accidentally download a fake bank account app?

If you suspect you’ve downloaded a fake bank account app, immediately uninstall it and contact your bank to report the incident. Change your passwords and monitor your accounts for any suspicious activity. Additionally, report the app to the app store and relevant authorities.

5. How can I protect myself from fake bank account apps?

Protect yourself by using multi-factor authentication for your bank accounts, regularly updating your passwords, and ensuring your smartphone’s operating system and apps are up-to-date. Always download apps from official app stores and stay informed about the latest security threats.

6. What are the signs that my bank account has been compromised by a fake app?

Signs that your account might be compromised include unauthorized transactions, unexpected changes in account balances, receiving alerts for activities you didn’t perform, or unusual requests for additional information from your bank.

7. How can banks help in preventing the spread of fake bank account apps?

Banks can enhance their app security with advanced encryption and biometric authentication features. They also play a crucial role in educating customers about potential threats and working with authorities to track and prosecute those behind these scams.

8. What steps should I take if I become a victim of a fake bank account app?

If you become a victim, immediately contact your bank to report the fraudulent activity and secure your account. Report the app to the app store and authorities such as the Federal Trade Commission (FTC). Seek support from a financial advisor or counselor to help recover and protect your financial health.

9. Why do people fall for fake bank account apps?

Scammers exploit human psychology using tactics like urgency, fear, and trust manipulation. For instance, they might create a sense of urgency by claiming your account will be locked unless you download their app immediately. Awareness of these tactics can help you stay vigilant.

10. How can I help spread awareness about fake bank account apps?

Share information with friends and family, encourage discussions about online safety, participate in online forums and social media groups dedicated to cybersecurity, and stay updated on the latest developments in digital fraud prevention. By building a community of awareness, you can contribute to a safer online environment.